Venture capital (VC) has become a cornerstone of the entrepreneurial landscape, acting as a crucial engine for innovation and business expansion. By providing essential funding and strategic support to high-potential startups, venture capitalists help turn visionary ideas into thriving enterprises. Understanding how venture capital works and its impact on the startup ecosystem offers valuable insights into its role in shaping the future of business and technology.

The Fundamentals of Venture Capital

Venture capital is a type of private equity investment focused on funding early-stage companies that have the potential for substantial growth. Unlike traditional loans, which require regular repayments, venture capital involves investing in exchange for equity—ownership stakes in the startup. This means that venture capitalists (VCs) share in the financial success or failure of the business.

The primary goal of venture capital is to support startups with innovative solutions, scalable business models, and high growth potential. While these investments are inherently risky, they offer the possibility of significant returns if the startup achieves substantial success. Venture capitalists are not only financial backers but also active partners in the growth journey of these startups.

The Role of Venture Capitalists

Venture capitalists play a multifaceted role in the startup ecosystem. Their involvement extends beyond just providing capital. VCs bring valuable industry experience, strategic guidance, and extensive networks that can be instrumental in a startup’s success. They often help startups refine their business models, develop go-to-market strategies, and navigate complex market dynamics.

Moreover, the involvement of a reputable VC can enhance a startup’s credibility and attract additional investors. Securing investment from a well-known venture capital firm serves as a validation of the startup’s potential and can increase its visibility in the market. This validation can also open doors to new opportunities, partnerships, and resources.

The Venture Capital Investment Process

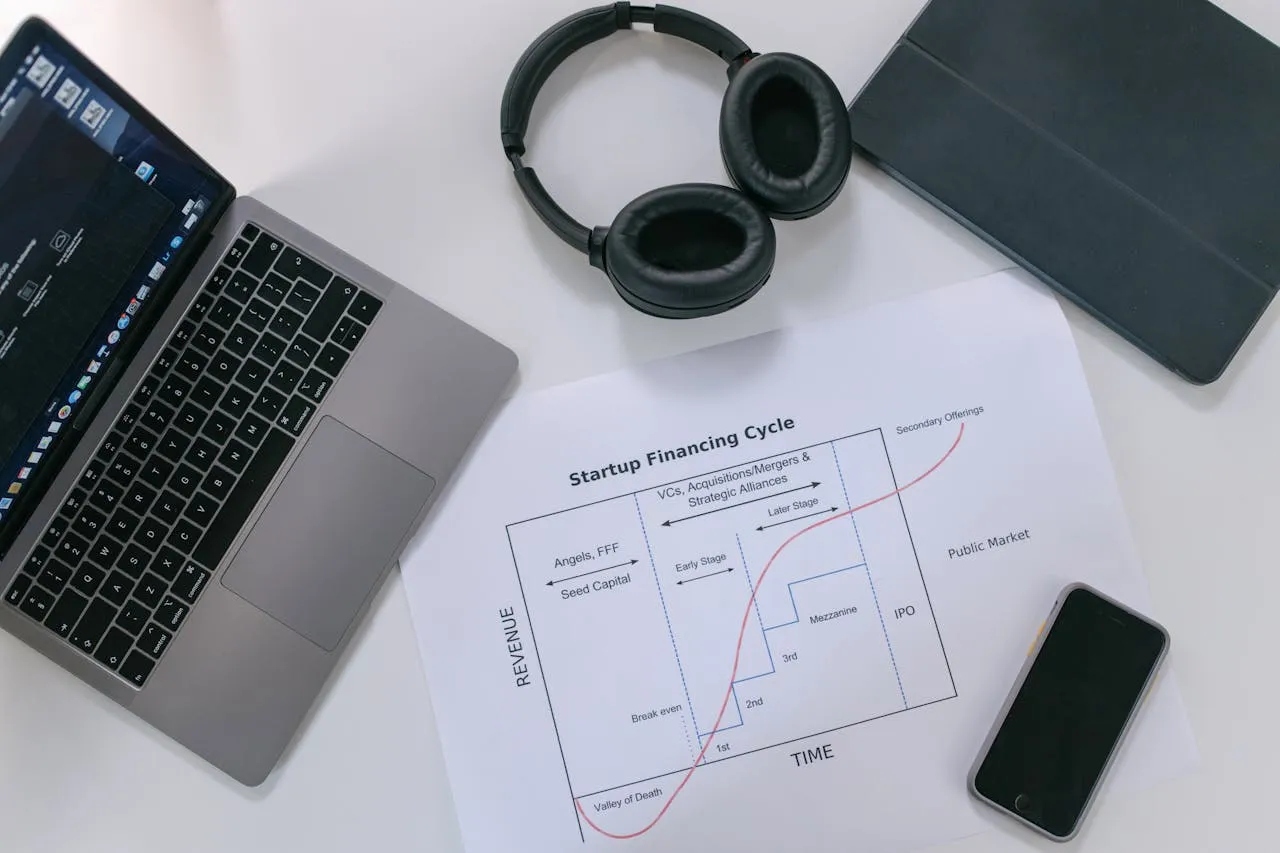

The venture capital investment process typically unfolds in several stages. It begins with startups pitching their ideas to potential investors. This pitch includes details about the business model, market potential, competitive landscape, and financial projections. If a venture capitalist finds the idea compelling, they conduct due diligence—an in-depth examination of the startup’s financials, technology, team, and market potential.

Upon successful due diligence, the VC and startup negotiate the terms of the investment, including the amount of funding, the percentage of equity, and any other conditions. Once an agreement is reached, the VC provides the necessary capital, and the startup begins to implement its growth strategies.

Investments are usually structured in multiple rounds, each corresponding to different stages of a startup’s development. Seed funding and Series A rounds focus on early development and market entry, while Series B and later rounds support scaling and expansion.

Challenges and Considerations

While venture capital offers numerous benefits, it also comes with challenges. For startups, securing venture capital can be highly competitive. They must present a strong value proposition and demonstrate significant growth potential to attract investors. Additionally, giving away equity can dilute the founders' ownership and control over the company.

For venture capitalists, the high-risk nature of early-stage investments means that not all ventures will succeed. VCs need to carefully assess potential risks and maintain a diversified portfolio to balance potential losses with high returns.

The Broader Impact of Venture Capital

The impact of venture capital extends beyond individual startups. By fueling innovation and supporting the growth of emerging companies, venture capital contributes to economic development, job creation, and technological advancement. Investments in sectors like technology, healthcare, and clean energy often lead to breakthroughs that address global challenges and improve quality of life.

Conclusion

Venture capital is a powerful force driving innovation and growth in the startup ecosystem. Through strategic investments, guidance, and networking, venture capitalists play a crucial role in helping startups achieve their potential. While the process involves risks and challenges, the contributions of venture capital to the advancement of technology and the economy are profound. As the entrepreneurial landscape continues to evolve, venture capital will remain a key driver of progress and success for emerging ventures.