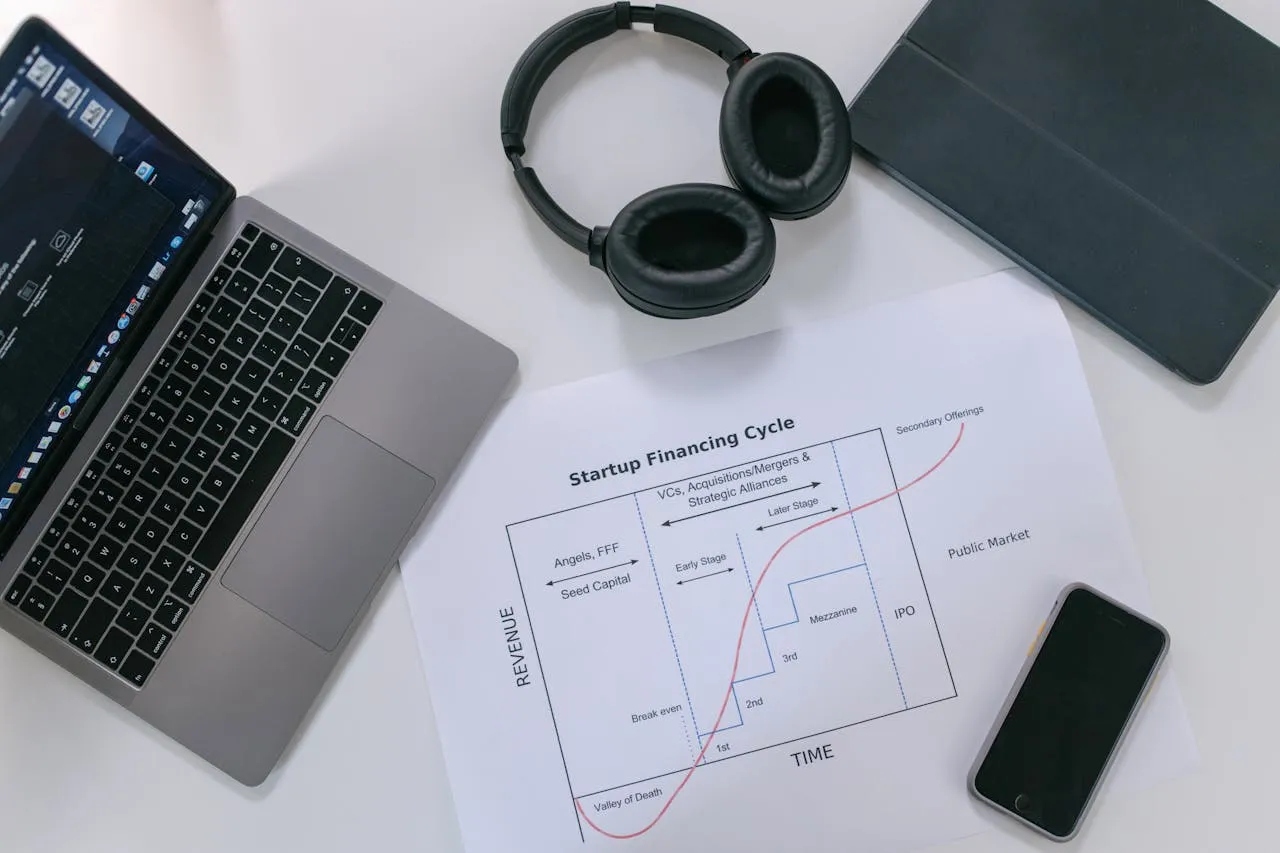

Venture capital (VC) has long been a driving force behind technological innovation, fueling the growth of companies that challenge conventions and introduce groundbreaking solutions. As the pace of technological advancement accelerates, the role of venture capital in shaping the future of technology has become increasingly critical. This article explores how venture capital is influencing the next wave of technological innovation, focusing on key trends, investment strategies, and the impact on emerging industries.

Driving Technological Advancement

Venture capital is a crucial catalyst for technological advancement, providing the financial resources and strategic support needed for startups to develop and commercialize new technologies. VC-backed companies are often at the forefront of innovation, working on cutting-edge technologies such as artificial intelligence (AI), quantum computing, and biotechnology. These technologies have the potential to revolutionize various sectors, from healthcare and finance to manufacturing and transportation.

For example, AI has become a major focus for venture capitalists due to its transformative potential. Startups developing AI-driven solutions for applications such as natural language processing, computer vision, and autonomous systems attract significant investment. VC funding enables these startups to advance their technologies, conduct research, and scale their operations, ultimately leading to the creation of new products and services that drive industry progress.

Emerging Investment Trends

The venture capital landscape is evolving to reflect emerging trends and opportunities in technology. One notable trend is the increasing interest in climate tech and sustainability. Startups that address environmental challenges, such as renewable energy, carbon capture, and sustainable agriculture, are drawing attention from VC firms seeking to invest in solutions that contribute to a more sustainable future. This shift reflects a growing awareness of the need for technological innovation to address global environmental issues.

Another significant trend is the rise of digital health and telemedicine. The COVID-19 pandemic accelerated the adoption of digital health solutions, including remote patient monitoring, telehealth platforms, and health data analytics. Venture capitalists are investing in startups that offer innovative solutions to improve healthcare delivery, enhance patient outcomes, and reduce costs. This sector’s growth is expected to continue as healthcare systems increasingly embrace digital transformation.

Strategic Approaches to Investment

Venture capitalists employ various strategies to identify and support promising startups. One approach is to focus on specific technology verticals or industries, allowing VCs to leverage their expertise and networks to identify high-potential opportunities. For instance, a VC firm with a strong background in fintech may concentrate on investing in startups that are developing innovative financial technologies, such as blockchain-based payment systems or AI-driven investment platforms.

Another strategy is to collaborate with corporate partners and industry experts to gain insights into emerging trends and technologies. Corporate venture capital arms, which are investment divisions of established companies, often work closely with startups to explore new technologies and foster innovation. These partnerships can provide startups with access to valuable resources, including industry expertise, market insights, and potential customer bases.

Impact on Emerging Industries

Venture capital’s influence extends to various emerging industries, shaping their development and growth trajectories. In the field of space exploration, for example, VC-backed companies like SpaceX and Blue Origin are leading the charge in advancing space technologies and expanding commercial opportunities in space travel and satellite deployment. Their innovations have the potential to transform the space industry and create new markets.

Similarly, the rise of the metaverse and augmented reality (AR) has attracted substantial venture capital investment. Startups developing AR experiences, virtual worlds, and immersive technologies are receiving funding to build and scale platforms that redefine how people interact with digital content and each other. These advancements have the potential to create new forms of entertainment, communication, and commerce.

Conclusion

Venture capital continues to play a pivotal role in shaping the future of technological innovation. By providing funding and strategic support to startups at the forefront of emerging technologies, VC firms drive progress and contribute to the development of groundbreaking solutions. As technological trends evolve and new opportunities arise, venture capital will remain a key driver of innovation, supporting the next wave of technological advancements and shaping the industries of tomorrow. The dynamic interplay between venture capital and technology underscores the importance of strategic investment in fostering innovation and driving long-term growth.