Venture capital (VC) has become a cornerstone of the modern entrepreneurial ecosystem, playing a pivotal role in funding and nurturing innovative startups. By providing essential financial backing, strategic guidance, and networking opportunities, venture capitalists help transform nascent ideas into successful enterprises. As technology and market dynamics evolve, so too does the role of venture capital in shaping the future of innovation. This article explores how venture capital is adapting to contemporary challenges and trends, and the impact it has on driving technological advancements and economic growth.

From Seed to Scale: How Venture Capital Supports Startups

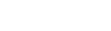

Venture capital is instrumental at various stages of a startup's lifecycle, from early seed funding to later-stage investments aimed at scaling operations. Seed funding, often the initial round of investment, provides startups with the capital needed to develop prototypes, conduct market research, and build a foundation for their business. At this stage, VCs typically look for high-potential ideas and passionate founders who demonstrate a clear vision and the ability to execute.

As startups progress, venture capitalists may participate in subsequent funding rounds—Series A, B, and beyond. These later-stage investments are crucial for scaling operations, expanding market reach, and accelerating growth. VCs provide not only capital but also strategic support, including mentorship, operational expertise, and access to a network of industry connections. This comprehensive support helps startups navigate challenges, optimize their business models, and achieve sustainable growth.

Adapting to Emerging Trends and Technologies

The venture capital landscape is continuously evolving to keep pace with emerging trends and technologies. In recent years, there has been a growing focus on sectors such as artificial intelligence (AI), blockchain, and renewable energy. Venture capitalists are increasingly seeking opportunities in these high-growth areas, recognizing their potential to drive transformative changes across industries.

AI and machine learning, for instance, have become focal points for VC investment due to their applications in various fields, including healthcare, finance, and autonomous vehicles. Startups leveraging AI to develop innovative solutions, such as predictive analytics or personalized medicine, attract significant interest from venture capitalists looking to capitalize on the potential for disruption.

Similarly, blockchain technology has garnered attention for its potential to revolutionize sectors such as finance, supply chain management, and data security. Venture capitalists are investing in startups that explore blockchain applications and develop solutions to address challenges such as transparency and efficiency.

The Rise of Impact Investing

An important trend in venture capital is the rise of impact investing, where VCs prioritize investments that generate social and environmental benefits alongside financial returns. This approach reflects a growing awareness of the broader impact of investment decisions and the desire to address pressing global challenges.

Impact investing encompasses a range of areas, including clean energy, sustainable agriculture, and social enterprise. Venture capitalists who focus on impact investing seek to support startups that contribute to positive societal outcomes while delivering competitive returns. This approach aligns with the increasing emphasis on corporate social responsibility and the desire for investments that contribute to a more sustainable and equitable future.

Challenges and Opportunities for Venture Capitalists

Despite its crucial role, venture capital faces several challenges. The high-risk nature of investing in startups means that many ventures may not achieve the anticipated success, leading to a need for careful due diligence and risk management. Additionally, the competitive landscape for attracting high-quality startups can be intense, requiring VCs to differentiate themselves through value-added services and strategic partnerships.

On the other hand, venture capital presents numerous opportunities for growth and innovation. The ongoing evolution of technology, coupled with emerging market trends, provides fertile ground for identifying and nurturing groundbreaking startups. By staying abreast of industry developments and adopting flexible investment strategies, venture capitalists can continue to drive progress and support the next generation of innovators.

Conclusion

Venture capital plays a vital role in shaping the future of innovation by providing crucial funding, strategic support, and industry connections to startups. As the venture capital landscape evolves to embrace new technologies and market trends, it continues to drive transformative changes across industries. By adapting to emerging opportunities and addressing challenges, venture capitalists contribute to the growth of groundbreaking startups and the advancement of technologies that will define the future. The dynamic nature of venture capital underscores its importance in fostering innovation and economic development in an ever-changing world.