Venture capital (VC) is a powerful force that fuels innovation and accelerates the growth of early-stage startups. By providing essential funding and strategic support, venture capitalists (VCs) play a pivotal role in transforming groundbreaking ideas into successful enterprises. Understanding the fundamentals of venture capital, its investment process, and its impact on the startup ecosystem reveals how it shapes the future of business and technology.

The Basics of Venture Capital

Venture capital is a form of private equity investment that focuses on funding startups with high growth potential. Unlike traditional loans, which require regular repayments, venture capital involves investing in exchange for equity—ownership stakes in the company. This equity-based model aligns the interests of VCs with those of the startup founders, as both parties benefit from the company’s success.

Startups often seek venture capital when they need substantial funding to develop their products, scale their operations, or enter new markets. The funding provided by VCs is crucial for fueling innovation and overcoming the financial barriers that startups face during their growth phases.

The Role of Venture Capitalists

Venture capitalists are not just financial backers; they are strategic partners who offer a range of benefits to startups:

- Capital Investment: VCs provide the funding necessary for startups to advance their projects, hire talent, and expand operations. This financial support is critical for startups that may not yet be profitable or have access to traditional financing options.

- Expertise and Guidance: VCs bring extensive industry experience and knowledge to the table. They offer mentorship on various aspects of business development, including product strategy, market positioning, and operational efficiency. This guidance helps startups navigate complex challenges and make informed decisions.

- Networking Opportunities: Venture capitalists often have a broad network of industry contacts, including potential customers, partners, and additional investors. Startups benefit from these connections, which can lead to valuable partnerships, sales opportunities, and further funding.

- Governance and Oversight: VCs typically take an active role in the governance of their portfolio companies, often serving on the board of directors. This involvement helps ensure that the startup adheres to best practices, meets key milestones, and aligns with its long-term strategic goals.

The Venture Capital Investment Process

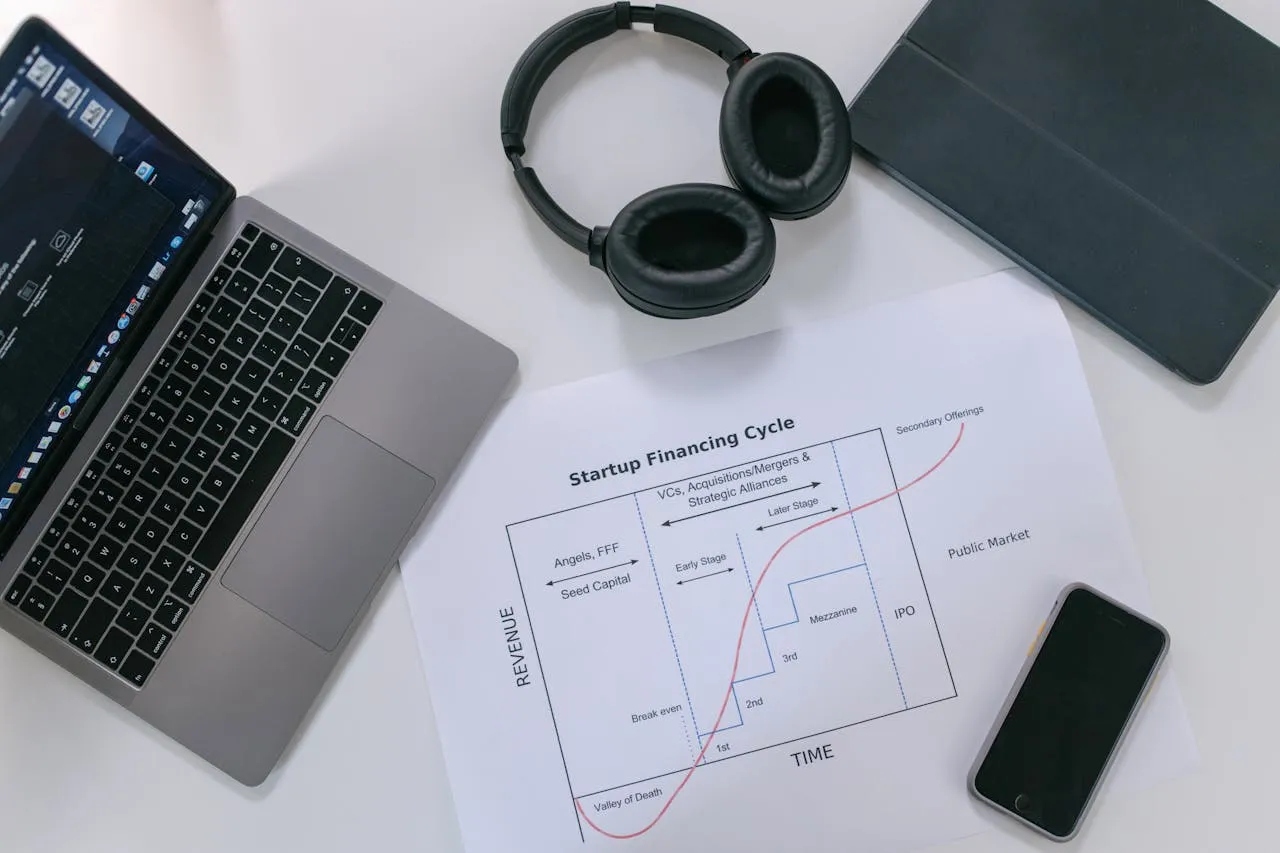

The venture capital investment process generally follows several stages:

- Pitching and Due Diligence: Startups present their business ideas to potential investors through pitches, outlining their value proposition, market opportunity, and growth potential. If the pitch is compelling, VCs conduct due diligence to evaluate the startup’s financials, team, technology, and market fit.

- Negotiation and Investment: Following due diligence, VCs and startups negotiate the terms of the investment, including the amount of funding, equity stake, and any specific conditions or milestones. Once agreed upon, the VC provides the capital and begins actively supporting the startup.

- Growth and Scaling: With the investment in place, startups focus on executing their growth strategies, leveraging the support and resources provided by their VCs. The goal is to achieve key milestones, scale operations, and increase market share.

- Exit Strategy: The ultimate aim of venture capital is often an exit event, such as an initial public offering (IPO) or acquisition. These exits provide a return on investment for the VCs and offer liquidity for the startup’s founders and early investors.

Challenges and Considerations

While venture capital offers numerous benefits, it also comes with challenges. Startups must navigate a competitive funding landscape and demonstrate significant growth potential to attract investors. Equity dilution, which results from giving away ownership stakes, can affect founders' control over their company.

For VCs, the high-risk nature of early-stage investments means that not all startups will succeed. Effective risk management, due diligence, and a diversified portfolio are essential for balancing potential losses with high returns.

The Impact of Venture Capital

Venture capital plays a crucial role in driving technological innovation and economic growth. By funding disruptive startups, VCs contribute to advancements in various fields, including technology, healthcare, and clean energy. Many of today’s leading companies began with venture capital support and have gone on to make significant contributions to society.

Conclusion

Venture capital is a key driver of startup success and innovation. Through financial investment, strategic guidance, and valuable networking, venture capitalists help transform promising ideas into influential businesses. While the process involves risks and challenges, its impact on the entrepreneurial ecosystem is profound, shaping the future of technology and business. As startups continue to push the boundaries of innovation, venture capital will remain an essential catalyst for their growth and success.