Venture capital (VC) is a pivotal element in the entrepreneurial ecosystem, serving as the lifeblood for startups with high growth potential. By providing not just funding but also strategic guidance and industry connections, venture capitalists (VCs) play a crucial role in transforming nascent ideas into successful businesses. Understanding the mechanics of venture capital and its impact on the startup landscape offers valuable insights into how new ventures are nurtured and scaled.

The Concept of Venture Capital

Venture capital is a form of private equity financing that targets early-stage companies with substantial growth potential. Unlike traditional loans, venture capital involves investing in exchange for equity, or ownership stakes, in the startup. This equity-based model means that VCs share in both the risks and rewards of the business, aligning their interests with those of the entrepreneurs.

Startups typically seek venture capital when they require significant funding to develop their products, scale operations, or enter new markets. In return for their investment, VCs expect a substantial return on investment (ROI), often realized through the startup’s eventual public offering or acquisition.

The Role of Venture Capitalists

Venture capitalists are more than just investors; they are strategic partners who provide valuable resources to startups. Their involvement often includes:

- Funding: VCs supply the capital necessary for startups to grow, from initial seed rounds to later stages of funding. This capital is crucial for product development, market expansion, and operational scaling.

- Mentorship: VCs offer strategic advice and guidance based on their extensive industry experience. They help startups refine their business models, develop effective go-to-market strategies, and navigate complex business challenges.

- Networking: Venture capitalists bring with them a vast network of industry contacts, including potential customers, partners, and additional investors. This network can be instrumental in accelerating a startup’s growth and opening doors to new opportunities.

- Governance: VCs often take an active role in the startup’s governance by serving on the board of directors. This involvement helps ensure that the startup adheres to best practices and aligns its strategies with long-term goals.

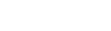

The Investment Process

The venture capital investment process typically involves several stages:

- Pitch and Evaluation: Startups present their business ideas to potential investors through pitches. These presentations outline the market opportunity, business model, competitive landscape, and financial projections. If the idea is compelling, VCs conduct due diligence to assess the startup’s viability.

- Negotiation: Following due diligence, VCs negotiate the terms of the investment, including the amount of funding, the percentage of equity, and any specific conditions or milestones.

- Funding and Support: Once terms are agreed upon, the VC provides the funding and begins offering strategic support. This support may include mentorship, access to networks, and guidance on scaling operations.

- Growth and Exit: VCs work closely with startups to help them grow and achieve their milestones. The ultimate goal is often an exit event, such as an initial public offering (IPO) or acquisition, which provides a return on investment for the VCs and the startup’s founders.

Challenges and Considerations

Despite its benefits, venture capital presents challenges for both startups and investors. Startups must navigate a highly competitive funding landscape and may face pressure to achieve rapid growth. Equity dilution can also affect founders’ control over their company.

For VCs, the high-risk nature of early-stage investments means that not all ventures will succeed. Effective risk management and a diversified investment portfolio are essential for balancing potential losses with high returns.

The Impact of Venture Capital

Venture capital has a significant impact on the economy and society. By funding innovative startups, VCs drive technological advancements, create job opportunities, and contribute to economic growth. Many successful companies that started with venture capital have gone on to make substantial contributions in fields such as technology, healthcare, and clean energy.

Conclusion

Venture capital is a critical driver of startup success and innovation. Through funding, mentorship, and strategic support, venture capitalists help turn promising ideas into impactful businesses. While the venture capital process involves risks and challenges, its role in fostering innovation and growth is undeniably transformative. As startups continue to push the boundaries of technology and business, venture capital will remain a key catalyst in their journey toward success.