Venture capital (VC) has emerged as a critical catalyst in the growth and success of startups, serving as a driving force behind innovation and technological advancement. This specialized form of investment, characterized by funding early-stage companies with high growth potential, plays a pivotal role in transforming nascent ideas into thriving businesses. Understanding the dynamics of venture capital and its impact on the startup ecosystem provides valuable insights into its transformative power.

The Essence of Venture Capital

Venture capital is a type of private equity investment that focuses on funding early-stage companies with high growth potential. Unlike traditional loans, which require repayment regardless of a company’s success, venture capital involves investing in exchange for equity. This means that venture capitalists (VCs) become partial owners of the startup and share in its financial success.

VCs typically look for startups with innovative ideas, scalable business models, and a strong potential for high returns. These investments are often high-risk but can yield substantial rewards if the startup achieves significant growth and profitability. The goal of venture capital is not just to provide funding but also to support startups in their journey to market leadership.

The Role of Venture Capitalists

Venture capitalists play a multifaceted role in the startup ecosystem. Beyond providing financial support, they offer strategic guidance, industry expertise, and valuable connections. VCs often have extensive networks that can help startups access potential customers, partners, and other investors. Their experience in scaling businesses and navigating market challenges provides startups with critical insights and mentorship.

The involvement of VCs can also enhance a startup’s credibility. Securing investment from a reputable venture capital firm can validate a startup’s business model and attract further investment. This validation can significantly boost a startup’s visibility and market potential.

The Venture Capital Investment Process

The venture capital investment process typically involves several stages. Initially, startups pitch their business ideas to potential investors, showcasing their market potential, business model, and growth strategy. If a venture capitalist is interested, they conduct due diligence, a thorough evaluation of the startup’s financials, market potential, and team.

Once due diligence is complete, the VC and startup negotiate the terms of the investment, including the amount of funding, equity stake, and other conditions. Upon agreement, the VC provides the funding, and the startup begins to execute its growth plans.

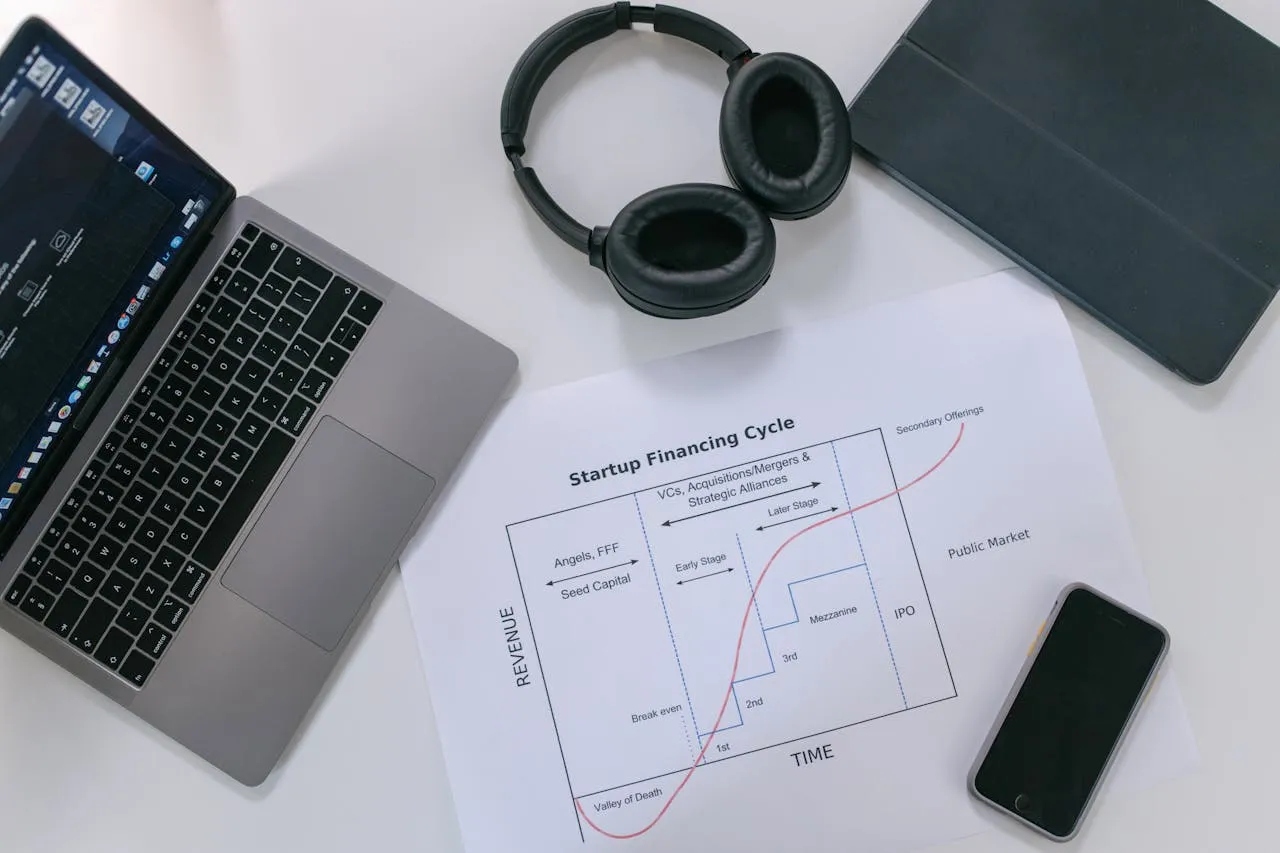

Venture capital investments are usually structured in multiple rounds, each corresponding to different stages of a startup’s growth. Early-stage investments (seed and Series A) focus on product development and initial market entry, while later-stage investments (Series B and beyond) support scaling, market expansion, and achieving profitability.

Challenges and Considerations

Despite its benefits, venture capital is not without challenges. For startups, securing venture capital can be highly competitive and demanding. They must craft compelling pitches and demonstrate significant growth potential to attract investors. Additionally, the equity stake demanded by VCs can dilute the founders’ ownership and control.

For VCs, the high-risk nature of early-stage investments means that not all investments will succeed. VCs must carefully assess and manage risks while maintaining a portfolio of diverse investments to balance potential losses with high returns.

The Impact of Venture Capital

The impact of venture capital on the startup ecosystem is profound. By providing the necessary funding and support, VCs enable startups to innovate, scale, and bring transformative technologies to market. This process drives economic growth, creates job opportunities, and fosters technological advancement.

Furthermore, venture capital has a ripple effect on various sectors. Investments in technology, healthcare, and clean energy, for example, contribute to advancements that address global challenges and improve quality of life. The success of venture-backed startups often leads to further innovation and investment in these fields.

Conclusion

Venture capital is a vital component of the startup ecosystem, fueling innovation and shaping the future of emerging companies. Through financial support, strategic guidance, and industry connections, venture capitalists play a crucial role in transforming nascent ideas into successful ventures. While the process involves risks and challenges, the contributions of venture capital to technological advancement and economic growth are invaluable. As the startup landscape continues to evolve, venture capital will remain a key driver of innovation and progress.